When most people think about asset protection and planning their estate, they focus on wills and trusts. While these are certainly important, there’s a simpler tool that many seniors overlook: beneficiary designations. These simple forms can have a powerful impact on how assets are protected and distributed, yet they’re often filled out hastily and then forgotten.

What Are Beneficiary Designations?

Beneficiary designations are the forms that are completed when retirement accounts, life insurance policies, and certain bank accounts are opened. On these forms, individuals name the person or people who will receive these assets when they pass away. Common accounts that use beneficiary designations include:

- IRAs and 401(k) plans

- Life insurance policies

- Annuities

- Payable-on-death (POD) bank accounts

- Transfer-on-death (TOD) brokerage accounts

Why They Matter for Asset Protection

Beneficiary designations matter because they trump a senior’s will. That’s right. No matter what the will says, the person named on the beneficiary form is who gets that account. This makes these designations incredibly powerful tools when it comes to asset protection.

When assets pass directly to a named beneficiary, they avoid probate entirely. Probate is the court process that validates the will and distributes the assets. By skipping probate, the senior’s beneficiaries can access these funds more quickly, with less expense, and with greater privacy. Probate records are public, but beneficiary designations keep financial matters private.

Additionally, assets that pass through beneficiary designations are generally protected from creditors. If seniors have outstanding debts at the time of their death, creditors typically cannot touch retirement accounts and life insurance proceeds that go directly to named beneficiaries.

Common Mistakes to Avoid

Many seniors make the mistake of naming their estate as the beneficiary, thinking this simplifies things. Unfortunately, this removes all the protections just discussed. The assets will go through probate and may be subject to creditor claims.

Another frequent mistake is failing to update beneficiaries after major life events. Did the senior get divorced? Remarried? Have a beneficiary pass away? If they haven’t updated their forms, they might be surprised by where their assets end up. An ex-spouse they meant to remove could still receive their life insurance payout if they never changed the form.

Seniors may also forget about contingent beneficiaries, the backup person who receives the assets if their primary beneficiary dies before them. Without a contingent beneficiary named, their assets may end up in probate after all.

Creating a Coordinated Strategy

Beneficiary designations should work together with the overall estate plan, not against it. What makes sense for one person might not work for another, especially if a blended family, minor children, or a child with special needs is involved.

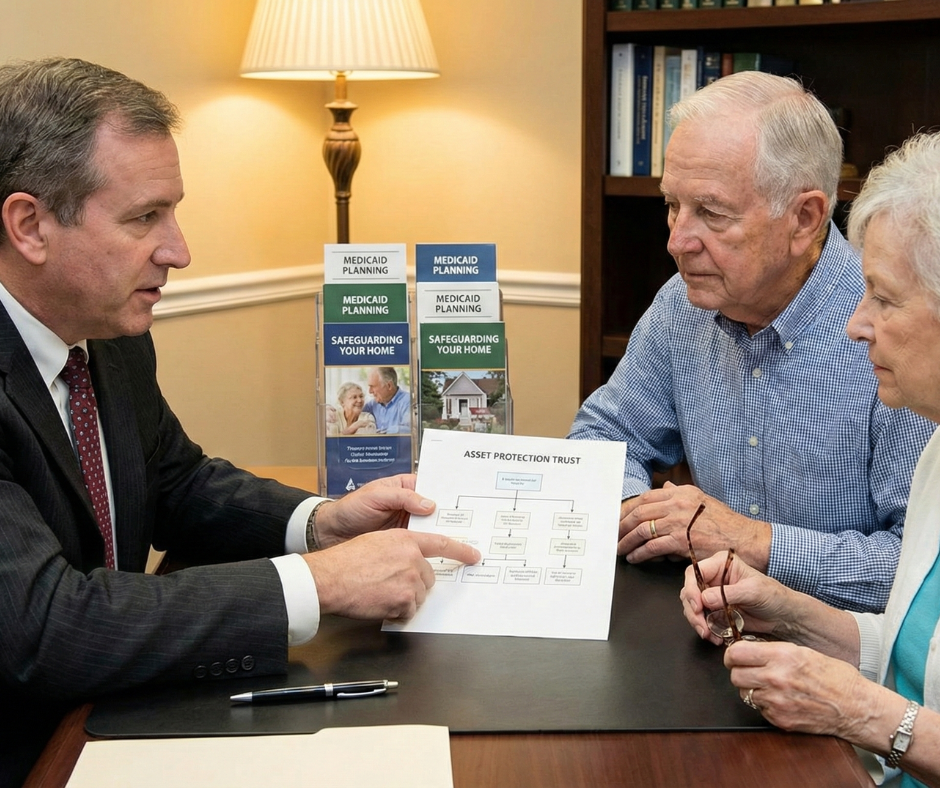

This is why working with a skilled attorney who specializes in elder law becomes invaluable. These professionals understand how beneficiary designations interact with Medicaid planning, special needs trusts, and other asset protection strategies. They can help seniors avoid unintended consequences and ensure their assets are protected and distributed according to their wishes.

Today is a good day to pull out those old beneficiary designation forms and review them with your loved one. Make sure they reflect the senior’s current wishes and life situation. Then, schedule a consultation with an elder law attorney to ensure their designations align with their comprehensive asset protection plan.

If you or a loved one needs assistance with Asset Protection in Pelham, AL, contact The Alabama Elder Care Law Firm, LLC, today at (205) 390-0101