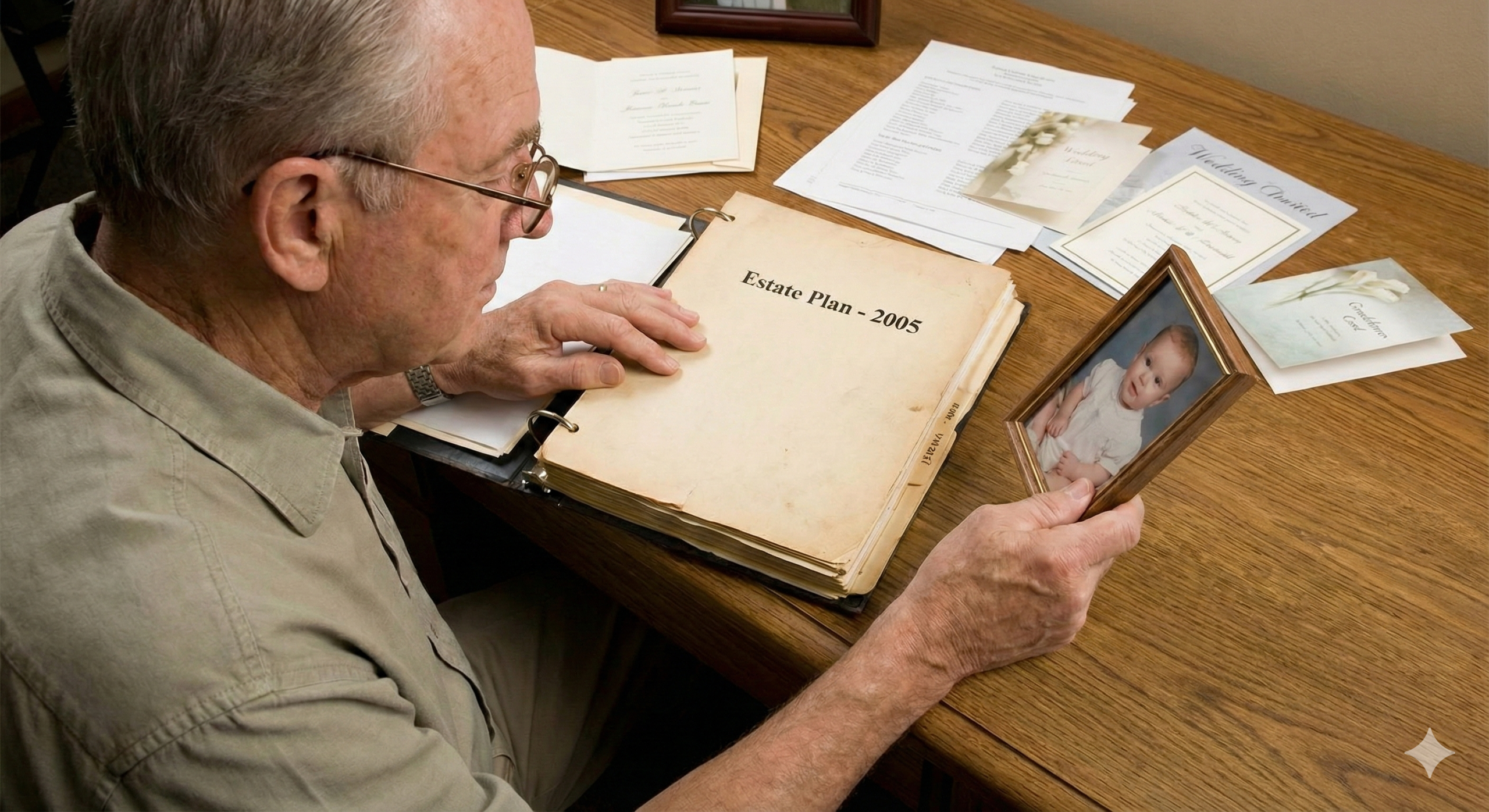

While creating an estate plan is a significant milestone, it’s not a one-time task. Life changes constantly, and an estate plan that made perfect sense five years ago might not reflect current circumstances or wishes. Knowing when to revisit estate planning can help seniors prevent problems like confusion, family disagreements, and more in the future.

Major Life Events Have Occurred

If a lot has changed in the senior’s life since they last updated their estate plan, that’s a clear clue that something is amiss. One such change is losing a spouse, which can make a significant difference in how they arrange their estate. The birth or adoption of grandchildren or great-grandchildren can also trigger the need to revisit estate planning, not to mention adult children who have been married or divorced.

Changes in health should also be considered. If the seniors receive a new diagnosis or their health gets worse, they may need to change their plans for healthcare proxies or long-term care.

Named Individuals Are No Longer Appropriate

Estate plans rely on specific people filling important roles. If the named executor has passed away, moved far away, or is no longer willing or able to serve, the plan needs updating. The same applies to trustees, healthcare proxies, and guardians for minor grandchildren.

Relationships can also change in unexpected ways. If there has been a falling out with the person designated to make healthcare decisions, or if someone named as a beneficiary is no longer in contact with the family, these situations require attention. Continuing to rely on outdated designations can lead to serious complications when the plan needs to be executed.

Finances Have Changed Significantly

It’s a good idea to revisit estate planning if finances have altered significantly. Seniors may decide to finally let go of a business, or their investments may increase—these things, and others, can lead to the estate growing and becoming more complicated. Real estate transactions might also come into play, such as selling the family home.

Laws and Tax Rules Have Evolved

State laws, estate tax benefits, and requirements change all the time. A few years ago, an estate plan might not have taken advantage of tax breaks that are available now, or it might have used tactics that don’t work as anticipated now. This is especially true for older persons who made their intentions a long time ago, when the law was completely different.

The Current Estate Plan Was Made Years Ago

Even if there aren’t any visible changes, time itself is a warning sign. Most estate planning professionals suggest individuals should go review their plans every three to five years. If seniors haven’t looked at their plan in ten years or more, they should probably look at it again, no matter what adjustments have been made.

Estate planning is ever-evolving, which means it is essential to review it every now and then to make sure it still reflects what the seniors want, as well as what they need. Ultimately, seniors and their families should see estate planning as an ongoing process, not simply a one-time thing.

If you or a loved one needs assistance with Estate Planning in Trussville, AL, contact The Alabama Elder Care Law Firm, LLC, today at (205) 390-0101